Client money protection made simple

Client Money Protect is the UK’s largest independent government authorised client money protection scheme, protecting the money residential property agents hold, on behalf of their clients.

Benefits of joining Client Money Protect

Legal requirement

All letting and property agents must have client money protection if they handle client money such as taking rent on behalf of a landlord.

Independent

We are an independent provider who you can join without being a member of a trade body.

Government approved

We are authorised by the Department for Levelling Up, Housing and Communities.

It is easy to join, just make sure you have the following before you apply:

Client account

You will need to have a ring-fenced client money account with a UK bank or building society, that is authorised by the Financial Conduct Authority and covered by the Financial Services Compensation Scheme.

All the client money you hold, such as rents and deposits will need to be held in your client account(s).

*Please note we are unable to consider any applications without all of the required documents. To avoid your application being rejected please ensure that you only apply when you have everything ready i.e Bank Letter, PI Certificate, Redress Scheme Membership Certificate, and Deposit Scheme Membership Certificate/Details.

Professional indemnity insurance

Your professional indemnity insurance must be appropriate for the size of your business.

If you do not have professional indemnity insurance, or you would like to compare prices, get a quote online with our partners CMPPI.

Tenancy deposit protection

If you take tenancy deposits you will need to be a member of a government authorised tenancy deposit protection scheme.

mydeposits are one of the longest standing government authorised deposit protection providers. For more information or to join mydeposits please see below.

Consumer redress

You will also need to be a member of a government authorised consumer redress scheme. For more information about redress schemes or to join one of the governments authorised redress schemes The Property Redress Scheme click below.

*Please note we are unable to consider any applications without all of the required documents. To avoid your application being rejected please ensure that you only apply when you have everything ready i.e Bank Letter, PI Certificate, Redress Scheme Membership Certificate, and Deposit Scheme Membership Certificate/Details.

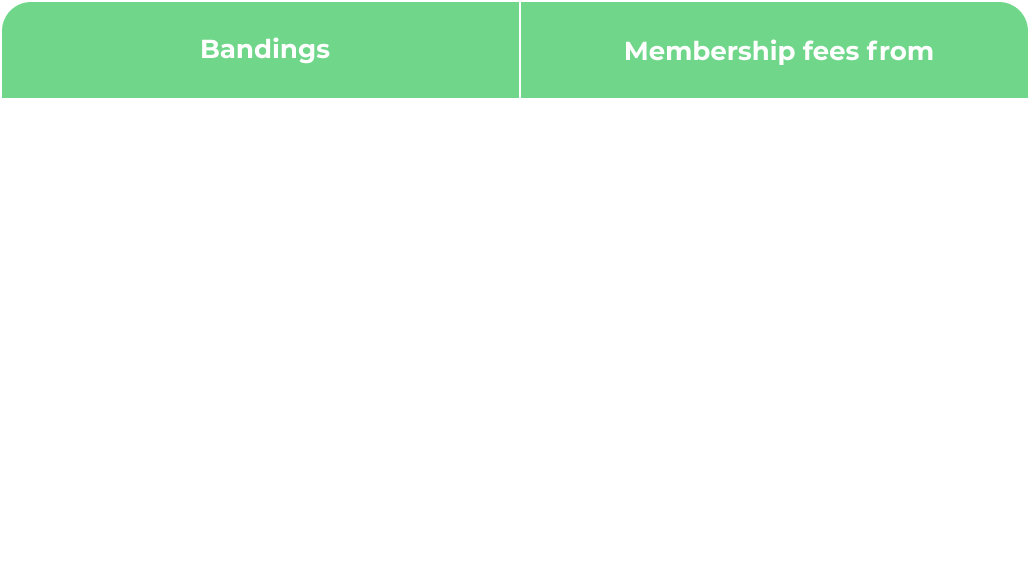

How much does Client Money Protect cost?

Members of Client Money Protect are charged an annual membership fee depending on the amount of client money they hold, excluding deposits that are already protected through an authorised tenancy deposit protection scheme.